PAN Card stands for Permanent Account Number; it is a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department of India under the Act 1961 and which is also serve as a ID Proof. It is also known as a unique National Identification Number as well.

[button-brown url=”#pan_benefit” target=”_self” position=”left”]Benefits of having a PAN Card[/button-brown][button-green url=”#pan_cost” target=”_self” position=”left”]How much PAN Card Costs ?[/button-green]

[button-red url=”#pan_apply” target=”_self” position=”left”]How to apply for a PAN Card ?[/button-red]

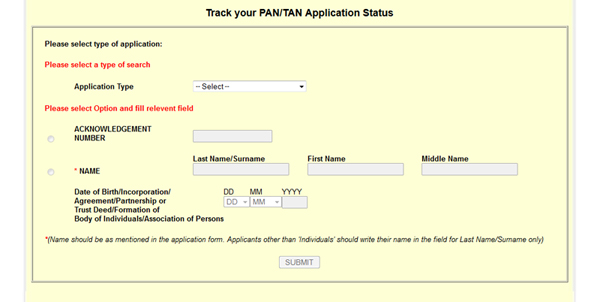

Applicant can check their PAN application status using the below form

Search By Acknowledgement Number

Pan card status can be checked by either entering 15 digit valid acknowledgement number or by entering full name with date of birth details in the search option.

Search By Name and DOB (Date of birth)

To check the position using name, applicants who are apart from ‘individuals’ like Association of Persons, Trust Deed/Formation of Body of Individuals, Incorporation or Agreement/Partnership should mention their name Surname(Last Name) field only.

Enter these details in the corresponding boxes in the Track your PAN/TAN Application Status Page Here

Benefits of having a PAN Card

- The very first & basic utility is, it serves as the unique & national ID proof for the citizen of India – in other countries as well.

- Change in address, state or country may affect other ID proofs. This is the only permanent ID proof that is unaffected by these alterations.

- For opening any Bank Account or for applying a Credit Card you need to have PAN Id.

- If a person wants to deposit amount more than Rs 50,000 than he/she should the Card works for the identification purpose.

- For opening & operating Demat account one must have one. This will enable the person buy or sell shares. He can do investments in mutual fund & debentures/bonds & securities beyond 1 lakhs in value etc.

- If you are looking forward to apply for the Passport then the card plays a very vital role as it works as a national ID proof.

- Cash expense of Rs.50,000 or more to obtain bank drafts, pay orders or banker’s cheques during any day require this Identification.

- If you are applying for any telephone connection including cellular connection or Internet connection companies get satisfied if they get tis nuber as an Identification proof.

How much PAN Card Costs ?

In previous articles we have received information pertaining to applying and guidelines for the PAN Card. One important point is, how much do we need to pay during the submission of application. This is for Indian Citizen and for NRI’s. The fees varies for both categories as mentioned here:

If communication Address is within India

(a). The fee for processing PAN application is 106.00 ( 93.00 + 14% service tax).

(b). Payment can be made either by

– Demand Draft

– Cheque

– Credit Card / Debit Card

– Net Banking

(c) If any of addresses i.e. office address or residential address is a foreign address, the payment can be made only by way of Credit Card / Debit card and Demand Draft payable at Mumbai.

If communication Address is outside India

(a). The fee for processing PAN application is 985.00[ (Application fee 93.00 + Dispatch Charges 771.00) + 14% service tax].

(b). Payment can be made only by way of Credit Card / Debit card and Demand Draft payable at Mumbai.

(c). At present the facility for dispatch of PAN cards outside India is available for a select list of countries. Applicants from other countries may contact NSDL at the contact details given in point (u) below.

How to apply for a PAN Card ?

Applying for PAN Card is as easy as doing any daily routine normal work, Income Tax Department now offering you so many ways to apply for the PAN Card like wise you can apply manually or online as well, here we will discuss ways that been providing by IT department for the convenience of their citizens and these points are as follows:

- From nearest UTI bank branch first you can have all basic information and form as well.

- If you want to apply online visit below website for more information

- https://tin.tin.nsdl.com/pan/form49A.html