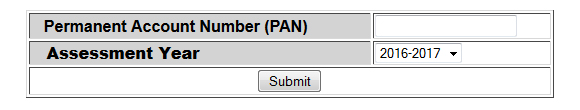

To Check Income Tax Refund Status online, you will need to enter Permanent Account Number (PAN) and the assessment year for which you want to track the income tax refund status.

Enter these 2 details in the corresponding boxes in the Tax Refund Status Page Here

Every person who is the resident of India has to pay the income tax to the government of India failing in which may put the person behind bars and is considered illegal. For paying the right amount of tax to the government it is important to have Income tax return filing. The Income tax return filing means the filing of the income tax on the income tax forms that are available at the department of the income tax office. For this person who has to go for the Income tax E filing has to stand in long queues at the IT department and then only they are able to get the various forms that are required for the Income tax return filing. Once they get the forms then they have to fill them and submit them at the IT office. Once this is done then the process of Income tax return filing is complete.

It is through the process of Income tax E filing only that the department is able to assess that how much tax each person has to pay. India has a huge population and it is not possible to find out the amount of tax that each person has to pay. Hence this system of Income tax return filing helps the IT department to ascertain the amount of tax to be paid. Now the government of India has introduced the process of online tax filing India. The Online tax filing India means the electronically filing the income tax returns. In this process all the work of income tax E filing is done with the help of the Internet and one is saved from standing in the long queues.